boulder co sales tax return form

Boulder 386 - 290 110 0985 8845. Add line s 9 10 and 11 late filing 13.

Balance due from Lodging Tax Return Attach copy of return 1.

. It will contain every up-to-date form application schedule and document you need in the city of Boulder the. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. If you have more than one business location you must file a separate return in Revenue Online for each location.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The combined rate used in this calculator 755 is the result of the Colorado state rate 29 the 80524s county rate 08 the Fort Collins tax rate 385. City of Boulder Sales Tax Form.

In all likelihood the Sales And Use Tax Return Form is not the only document you should review as you seek business license compliance in Boulder MT. The Colorado Department of Revenue publishes a series of publications called FYI For Your Information on several revenue areas one of them sales tax. Sales Tax Return Company Name 1.

Use the downloadable template on CocoSign website to write a City Of Boulder Sales Tax Forms easily. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. 441-3050Correspondence should be mailed to City of Boulder Sales Tax Division P O Box 791 Boulder CO 80306-0791If you are filing a late return calculate the amount of Interest and Penalty you owe and enter in theEnter the amount of bad.

Risk Free for 60 Days. You may get forms mailed directly to you by calling and leaving a message with your name and phone. DR 0594 - Renewal Application for Sales Tax License.

To manage your Colorado sales tax account file returns and pay state-collected sales taxes online. What is sales tax in Fort Collins CO. INSTRUCTIONS FOR COMPLETING THE FILLABLE SALES TAX RETURN FORM Line 1 List gross sales and services made in town during your reporting period both taxable.

No the university is not subject to sales tax on giveaway items. University of ColoradoNorlin Library Government Information Library - Staffed only on Fridays 1720 Pleasant Street Boulder 303-492-8834. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

Salestaxbouldercoloradogov o llamarnos a 303-441-4425. The libraries below will only carry Forms 1040 except CU which carries 1099 and 1096 forms as well. If return is filed add.

There are a few ways to e-file sales tax returns. For definition purposes a sale includes the sale lease or rental of tangible. Accounting records must be retained by the collecting entity for three years from the date of filing and paying a return.

DR 0235 - Request for Vending Machine Decals. About City of Boulders Sales and Use Tax. Line 7 minus line 8 10.

Bad Debts Collected. DR 0154 - Sales Tax Return for Occasional Sales. Sum of lines 1 and 2a a.

See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Boulder CO. Taxpayer name and address mail to. Gross Sales and Services 2.

Businesses located in the Center Fee districts sales tax rate is 175 and is in addition to the district fees. Reconciliation is a process of filing a construction use tax return upon completion of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax. Filing of the return is required for all construction projects where the final contract price is 75000 or more.

Ad Automate sales tax returns with our low cost solution built for mulit-channel sellers. We recommend that you obtain a Business License Compliance Package BLCP. DR 0154 - Sales Tax Return for Occasional Sales.

Boulder Colorado 80306 Single Event 303 441-3050 or 441-3051 Please State Date _____ 1 2 DEDUCT. Balance due from lodging tax return attach copy of return 1. Vendor FeeNet Broomfield City and County Sales Tax.

Max 200 Enter -0- on Late Return 9. GROSS SALES SERVICES. Round to even 11.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Vendor In-House Consumption 3. Publication 32 titled Gifts Premiums and Prizes states Purchases of tangible personal property for use as gifts premiums or prizes for which no valuable.

Longmont sales tax division 350 kimbark st longmont co 80501. SALES TAX RETURN FILING INSTRUCTIONS RETURN WITH PAYMENT - STANDARD MAIL City of Brighton PO Box 913297 Denver CO 80291-3297. Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The 80524 Fort Collins Colorado general sales tax rate is 755. The 2022 sales tax rates for taxing districts in Boulder County are as follows.

Para asistencia en español favor de mandarnos un email a. CERTIFIED OR EXPRESS DELIVERY 500 South 4th Avenue Brighton CO 80601 Attn. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

File sales tax faster with Avalara Returns for Small Business. Colorado Department of Revenue Sales Tax Division 303-238-7378 Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. For businesses located in special district ONLY 1 a.

Get started with a sales tax boulder form 0 complete it in a. City of boulder sales tax form. How 2019 Sales taxes are calculated for zip code 80524.

PO Box 471 Boulder CO 80306. The City of Lovelands sales tax rate is 30 combined with Latimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. File Sales Tax Online.

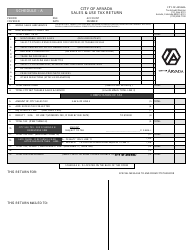

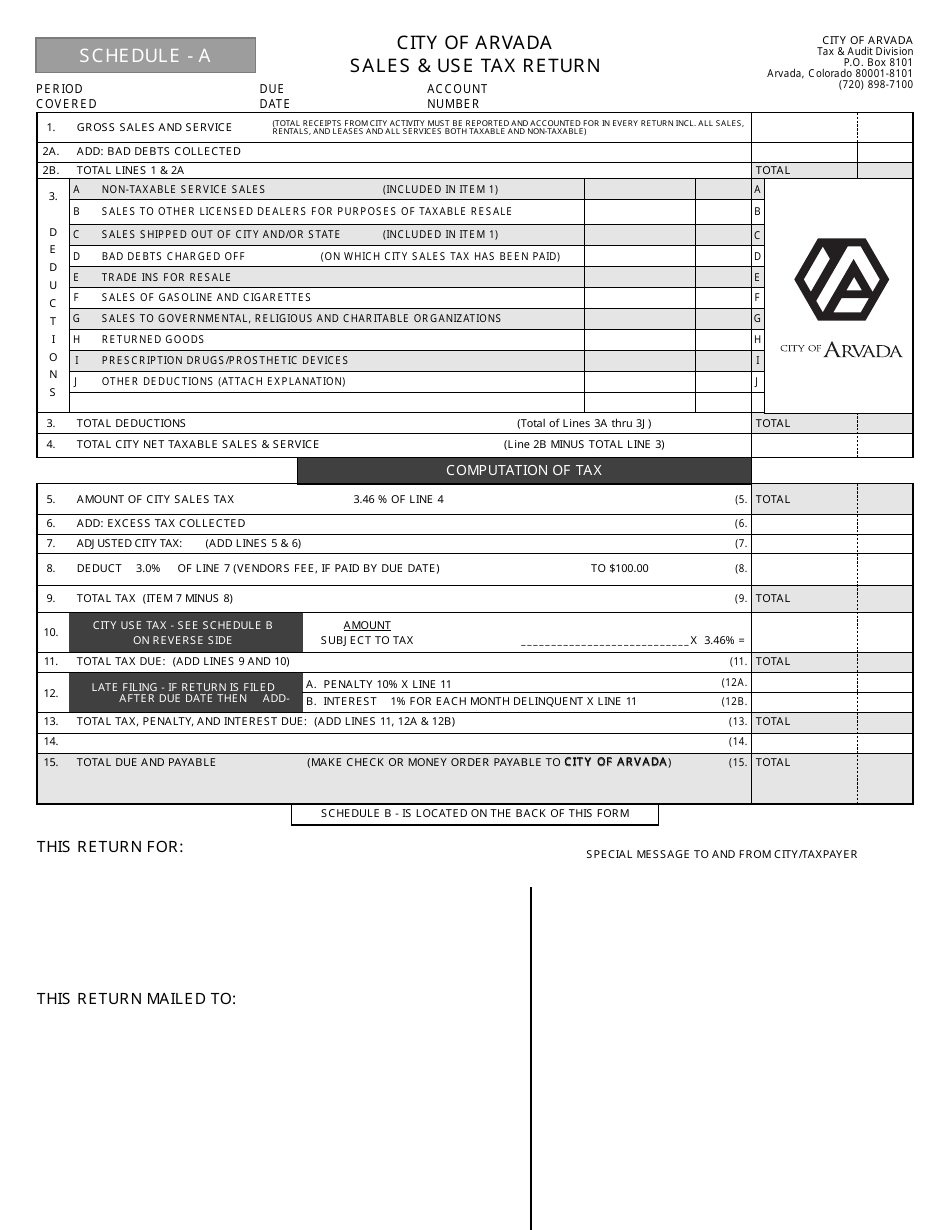

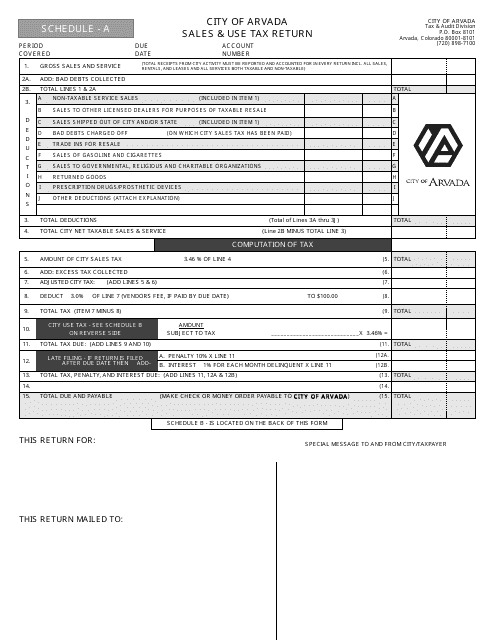

City Of Arvada Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

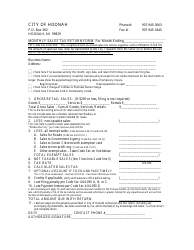

City Of Hoonah Alaska Monthly Sales Tax Return Form Download Printable Pdf Templateroller

Home Tax Forms And Instructions Research Guides At University Of Colorado Boulder

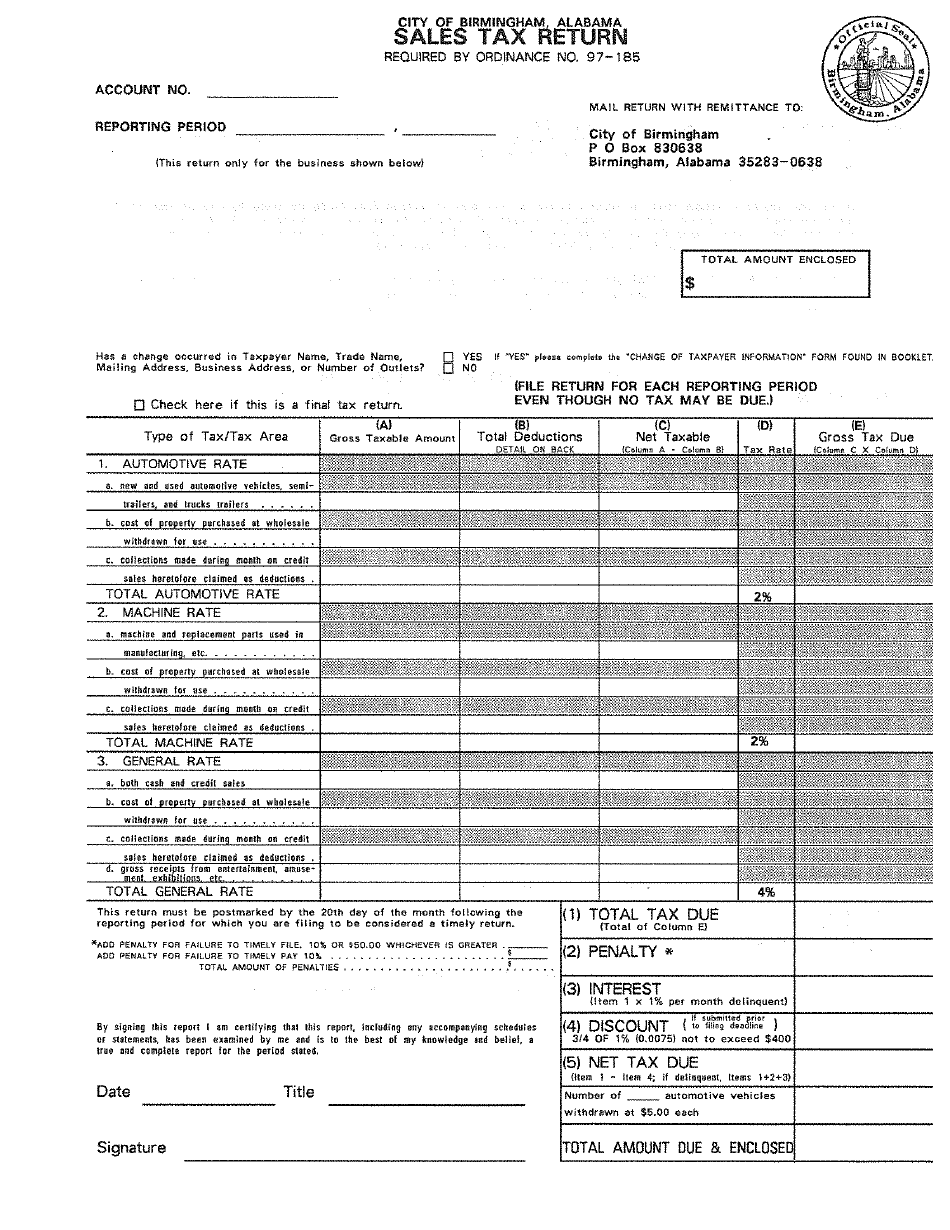

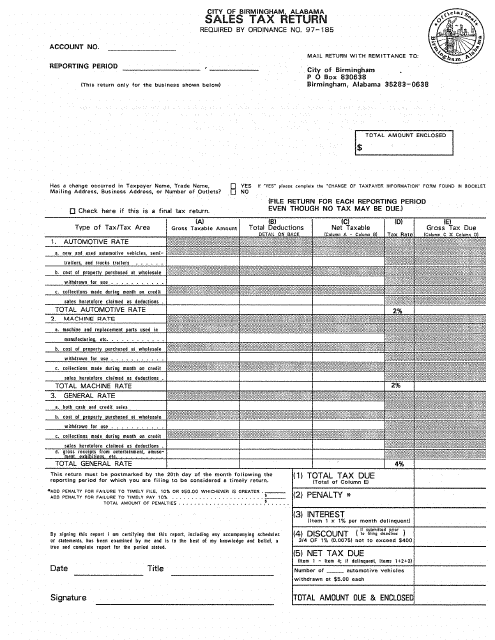

City Of Birmingham Alabama Sales Tax Return Form Download Printable Pdf Templateroller

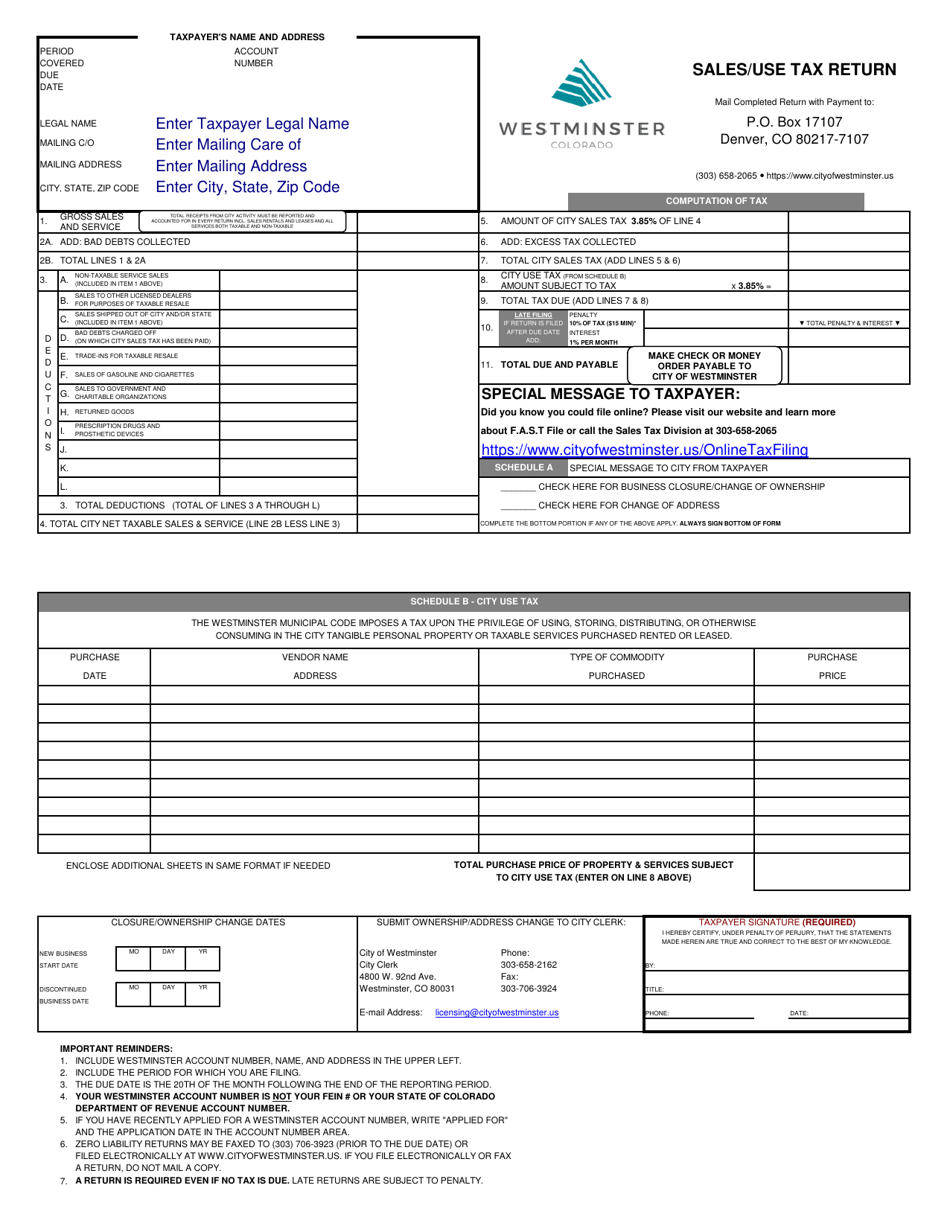

City Of Westminster Colorado Sales Use Tax Return Download Fillable Pdf Templateroller

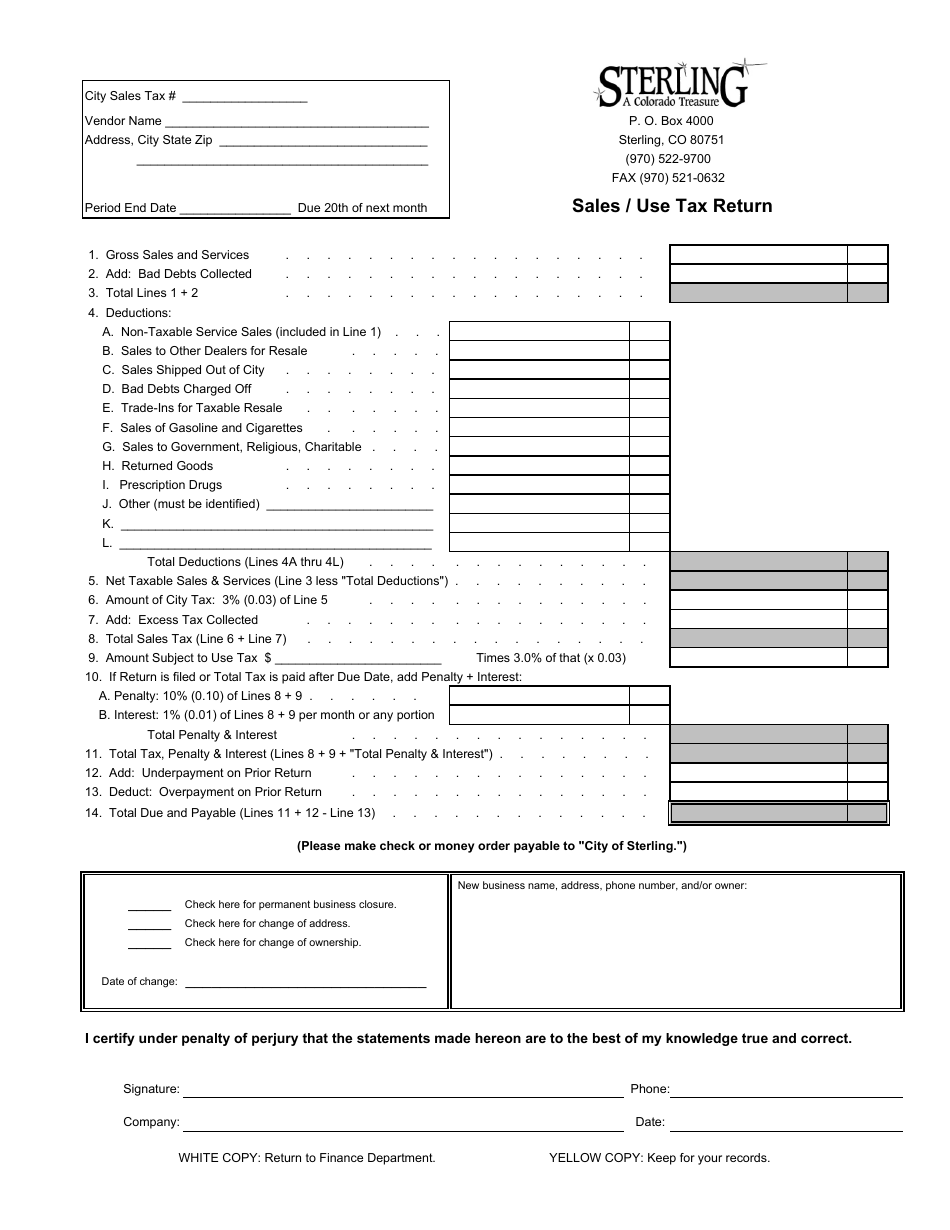

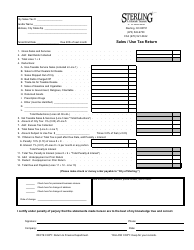

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

City Of Arvada Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

City Of Birmingham Alabama Sales Tax Return Form Download Printable Pdf Templateroller

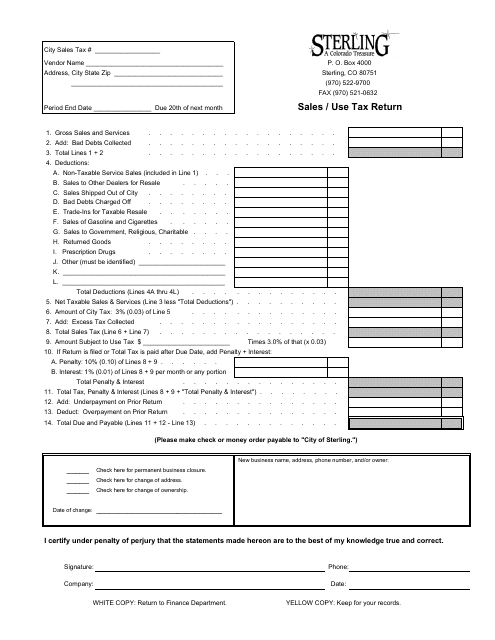

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

City Of Birmingham Alabama Sales Tax Return Form Download Printable Pdf Templateroller

City Of Arvada Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller